In today’s fast-paced digital world, safeguarding your finances is more important than ever. That’s where MOVO steps in, offering innovative solutions to protect your money while keeping convenience at the forefront. With their Digital CASH Card®, you can enjoy peace of mind while navigating the digital banking landscape.

When considering the anatomy of a CASH Card®, it’s worth noting the multiple layers of protection it offers. Storing your card information electronically can save time, but it also exposes you to risks. With MOVO, you can create digital CASH Cards® designed specifically for online purchases and subscriptions, minimizing the threat of hacking.

Engineered for optimal security

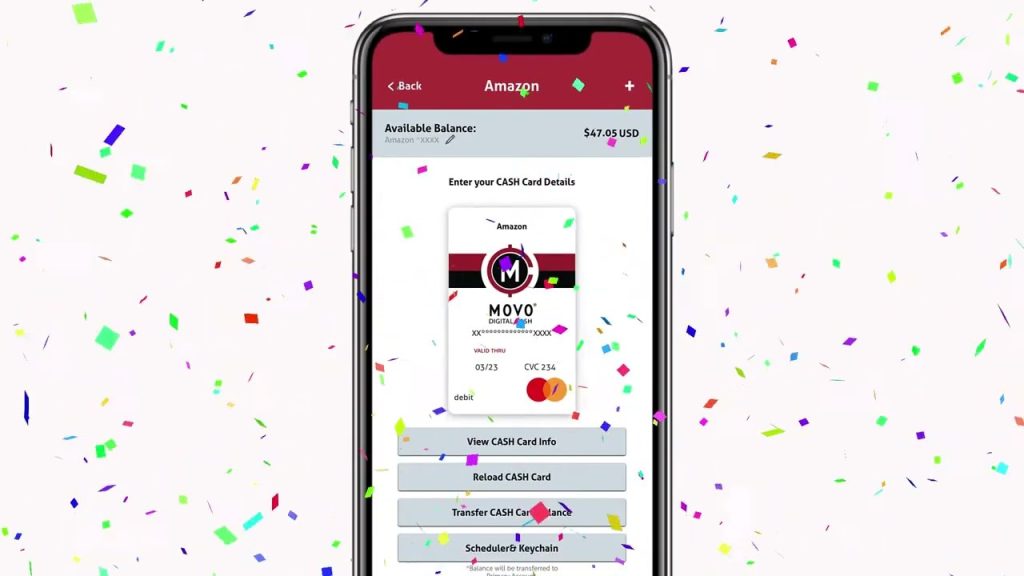

The MOVO Digital CASH Card® is not just another virtual card; it’s an advanced tool engineered to secure your finances. With features like digital Debit Mastercard® compatibility, you can use your CASH Card® anywhere Mastercard® is accepted.

This flexibility ensures you are not limited while maintaining security. Additionally, integrating your CASH Card with MOVO and Apple Pay digital wallets facilitates secure, end-to-end transactions. This feature-rich platform simplifies cash flow management, offering an easy-to-use ledger within the app to track, load, and reload funds as needed.

Practical application of digital cash cards

Using MOVO’s Digital CASH Card® effectively requires understanding its practical applications. Whether you’re ordering products online or subscribing to a new service, the CASH Card® protects against double charges and other billing issues.

It’s as simple as entering the digital card information in place of your primary card, removing inherent risks associated with exposing your main account details. This method reduces financial exposure and is a significant deterrent to fraud, keeping your primary accounts secure while enjoying hassle-free digital shopping.

With the foundational security of digital CASH Cards® in place, let’s explore how MOVO enhances this layer of protection. Funds are readily available through a digital Debit Mastercard®, expanding possibilities while keeping security a priority.

The CASH Card’s integration with digital wallets further cements its position as a versatile and secure financial tool. This added layer of security, combined with an intuitive interface for cash flow management, makes it a comprehensive solution for the modern digital consumer.

Optimize your financial security

In conclusion, MOVO’s Digital CASH Card® is a versatile and secure alternative for managing your online transactions. By isolating your main account from potential online threats, it safeguards against unauthorized access and financial scams.

Whether you’re new to digital banking or a seasoned user, it’s crucial to prioritize security while benefiting from the convenience these services offer. Embrace the future of digital banking with confidence, knowing your finances are protected like a ninja, thanks to MOVO’s innovative approach.

Finally, integrating security features such as MOVO’s Digital CASH Card® into your financial strategy is key to protecting your wealth in the digital age. By taking advantage of this advanced tool, you can confidently navigate the world of online transactions. Embrace these security measures today, and rest easy knowing your finances are safe and your transactions smooth.